Obama’s 2016 Budget Proposal

Middle Class Economics: The President’s Fiscal Year 2016 Budget

President Obama has released his 2016 proposed budget plan. As quoted from President Obama:

“The ideas I offer in this Budget are designed to bring middle-class economics into the 21st Century. These proposals are practical, not partisan. They’ll help working families feel more secure with paychecks that go further, help American workers upgrade their skills, so they can compete for higher-paying jobs, and help create the conditions for our businesses to keep generating good new jobs for our workers to fill. The Budget will do these things while fulfilling our most basic responsibility to keep Americans safe. We will make these investments and end the harmful spending cuts known as sequestration, by cutting inefficient spending, and closing tax loopholes. We will also put our Nation on a more sustainable fiscal path by achieving $1.8 trillion in deficit reduction, primarily from reforms in health programs, our tax code, and immigration.”It ends sequestration.

Response to the budget has been on both ends of the spectrum in terms of the worst thing for the economy to the best thing for the economy.

Some positives of the proposed 2016 Budget:

- It ends sequestration.

- It sets up an infrastructure fund.

- It increases the child care credit for middle class families.

- Read the complete list here: http://www.whitehouse.gov/omb/overview

Some Negatives of the proposed 2016 Budget:

- While deficits decrease relative to GDP, they still increase $485B to $687B.

- Spending increases from $3.5T to $6.2T

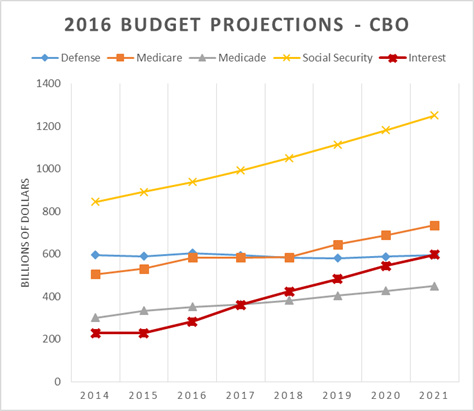

- Federal interest payments will pass defense spending in 2021

- Individual income taxes rise to 10% of GDP from current 8% of GDP while corporations remain flat at 1.9%.

Key Data Points From President Obama’s 2016 Budget:

Overall Spending Vs. Revenues for the 2016 Proposed Budget

Key Spending Trends:

From The CBO on Economic Outlook

Taken from the CBO 2014-2022 Economic outlook report:

The Budget Deficit Continues to Shrink in 2014, but Federal Debt Is Still Growing

The federal budget deficit for fiscal year 2014 will amount to $506 billion, CBO estimates, roughly $170 billion lower than the shortfall recorded in 2013. At 2.9 percent of gross domestic product (GDP), this year’s deficit will be much smaller than those of recent years (which reached almost 10 percent of GDP in 2009) and slightly below the average of federal deficits over the past 40 years. However, by CBO’s estimates, federal debt held by the public will reach 74 percent of GDP at the end of this fiscal year—more than twice what it was at the end of 2007 and higher than in any year since 1950.

………

The large and increasing amount of federal debt would have serious negative consequences, including the following:

- Increasing federal spending for interest payments,

- Restraining economic growth in the long term,

- Giving policymakers less flexibility to respond to unexpected challenges, and

- Eventually increasing the risk of a fiscal crisis (in which investors would demand high interest rates to buy the government’s debt).Outlays

Between 2014 and 2024, annual outlays are projected to grow, on net, by $2.3 trillion, reflecting an average annual increase of 5.2 percent. Boosted by the aging of the population, the expansion of federal subsidies for health insurance, rising health care costs per beneficiary, and mounting interest costs on federal debt, spending for the three fastest-growing components of the budget accounts for 85 percent of the total projected increase in outlays over the next 10 years:

- Annual spending for Social Security is projected to grow by almost 80 percent. Under current law, outlays for that program would climb from 4.9 percent of GDP this year to 5.6 percent in 2024, according to CBO’s estimates.

- Annual net outlays for the government’s major health care programs (Medicare, Medicaid, the Children’s Health Insurance Program, and subsidies for health insurance purchased through exchanges) are projected to rise by more than 85 percent. Outlays for those programs would grow from 4.9 percent of GDP to 5.9 percent, CBO anticipates.

- Outlays for net interest in 2024 are projected to be more than triple those in 2014—the result of both projected growth in federal debt and a rise in interest rates. Net interest outlays would rise from 1.3 percent of GDP this year to 3.0 percent by the end of the coming decade, CBO expects.

In contrast, taken together, all other spending is projected to grow by only about 20 percent. Relative to GDP, such spending would fall—from 9.3 percent this year to 7.3 percent by 2024, its lowest percentage since 1940 (the earliest year for which comparable data have been reported).

Total outlays in the baseline amount to 20.4 percent of GDP in 2014, hover around 21 percent (their average for the past 40 years) from 2015 through 2020, and then rise to about 22 percent from 2022 through 2024. In CBO’s projections, both net interest and mandatory spending grow relative to GDP from 2014 to 2024, by 1.7 percent and 1.4 percent, respectively; discretionary spending falls by 1.6 percent of GDP over that period.